Have you given up trying to take control of your finances? Are you afraid of your money? Your attitude towards money can affect you positively or negatively. Luckily, even if the thought of your finances fills you with dread, you can take certain actions that will enable you to take back control.

These tips will help you get a handle on your finances.

Do a Finance Check.

- Sit down with your partner, family and get a handle on exactly where you are right now! Good or bad, you need to know accurately what your financial situation is, before you can start. Now you can plan!

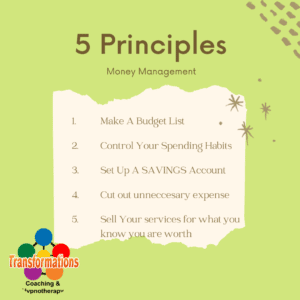

- Create a budget. This step is essential. An Excel/Google Docs spreadsheet is the perfect tool to do this. (follow this link for a basic budget spreadsheet template)

- Where does your money come from? Enter it all into the spreadsheet. If you are a wage earner, put in your wages, net of income tax and deductions.

- Fixed Expenses. These are the things you cannot change. Rent, insurance, (car and house); school fees/books etc. make a note if these expenses are weekly, monthly, annually and separate accordingly. Also, separate ‘payment plan accounts’ Things like Afterpay; GE Money; Hire purchase agreements. Quite often this will give you a bit of a reality check – how much money is ‘pre-spent’ before you even get paid?

- Fluctuating Expenses. These are expenses that vary depending on circumstances. Perhaps, you would have groceries, fuel, presents, holidays, entertainment in here.

Build Your CashFlow

Go through all the bills you have received in the past 3 months. Look at your credit card statements – what do you spend your money on? Where can you see you waste the odd dollar or ten? Be ruthless! Circle anything you can eliminate or cut back on.

Don’t be afraid to handle your own bills. If you’re in the habit of having someone else handle your bills, begin doing them on your own and understand them. Take one day a month to sit down, go over your bills, and pay them. Managing family finances should be a family affair! Teach your children how to handle money, how to save, budget and invest.

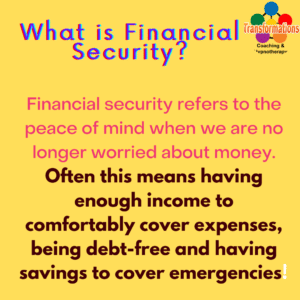

Cash Flow is King!

- Do you have a ‘rainy day’ account? A good strategy is to have sufficient funds saved to be able to live for 3 months on your ‘emergency funds.’ How long could you survive without an income? Are you secure when you look at the picture your finances shows you?

Whether you are single, a couple, a family, or a business your finances are a business – Your Business! Manage it as such. Now you know your Income, you have a list of your expenses and spending, what is your ‘profit?’ As a business, how are you doing? Succeeding or failing? Is it time to take control of your finances?

Could you be doing better? Probably. I think most of us know we ‘waste’ money every month. So, here is a few tips on how to streamline and manage your money a little better to save more and invest $$ into areas to increase your income and give you more control.

Consider a consolidation loan or refinancing your mortgage. If you have a lot of instalment loans and credit cards, you may want to consider getting a consolidation loan. This type of loan combines all of your payments so you just make one per month and save money on interest fees. Refinance your mortgage. When interest rates are lower than the one you started your mortgage with, you may be able to save thousands of dollars on your mortgage by refinancing. This is particularly true if you intend to stay in your house for years. Do the math to see if refinancing would be advantageous for you.

Focus on Saving not Spending

7. Ensure you’re saving money every month. A good rule of thumb to follow is to save 10% of your salary each month and put it into an account that earns interest. Once you’ve built an emergency fund that you’re comfortable with, start investing your savings.

8. OPEN several savings accounts for:

- Christmas and birthday presents

- Travel / holidays

- Car repairs – registration – replacement

- Special Occasions

9. Make Automated transfers into these sub-accounts every payday! You will be amazed how much you save when you automate the process.

I personally pay quarterly bills such as rates, electricity, as per my income cycle. I know approximately what the quarterly amount is: I divide by 13 and pay that amount every week. This saves a ‘surprise’ bill when I need it least.

Invest Wisely

10. Invest wisely. Make investing automated – annuities/shares / Bitcoin. Seek professional help from a financial advisor if you’re unsure which investments would be right for you.

11. Pay Credit Card balance in FULL on time every month. Automate the payment.  Better still cut up your credit cards and don’t get sucked into the credit cycle. If you have outstanding balances on cards, transfer to another bank with lower interest and interest-free period – BUT Do not use the card! You will incur ongoing fees if you do.

Better still cut up your credit cards and don’t get sucked into the credit cycle. If you have outstanding balances on cards, transfer to another bank with lower interest and interest-free period – BUT Do not use the card! You will incur ongoing fees if you do.

12. Review Weekly / Monthly Once you set up your budget, diligently review weekly to start with and then move to monthly. This is not a budget to eliminate fun! Fun is part of life, so are treats and special occasions. But control what you spend every day, to ensure you can pay for the ‘special’ times when they occur.

Rethinking your spending to take control of your finances may take some patience on your part. These tips will help. Just try one strategy at a time. Once you get used to that strategy, add another. Repeat this routine until you’ve mastered all 12 tips. If you need further assistance, it could be beneficial to hire a financial planner to guide you through the details.

Summary:

Find out where you are/build a budget / automate everything/stick to the budget / save/save/save!

When you take control of your finances, your life opens up to possibilities. You will be so glad you did!